Despite the fact that many investors publicly banned the controversial EACOP pipeline they still plough USD five billion into one of the owners of the pipeline, China’s parastatal oil company, CNOOC.

As reports about the East African Crude Oil Pipeline’s (EACOP) negative impacts on the climate, environment, and human rights continue to attract public attention, several leading investors have announced that they will no longer finance the project.

Since 2018, the consortium behind EACOP – led by the French multinational TotalEnergies – has acquired farmland and houses along the 1,443 km pipeline route between Uganda’s Lake Albert and the shore of Tanzania. According to a resolution of the European Parliament this has placed over 100,000 people in Tanzania and Uganda at risk of imminent displacement.

In the wake of EACOP’s harmful impacts coming to light, several leading banks, underwriters, insurance companies and investors have publicly declared that they would withdraw involvement in this project. In recent years, banks like Citigroup, HSBC, Mizuho, Société Générale, Mitsubishi UFJ, Credit Suisse and JP Morgan Chase have formally stated that they will not be a part of EACOP.

Yet words, without follow-through, are cheap. Despite their public pledges, research by Just Finance International (JFI) has found that all above-mentioned banks and several other leading investors are still backing EACOP through one of its financing partners, the Chinese parastatal oil company called China National Offshore Oil Corporation (CNOOC). CNOOC is one of the shareholders in the EACOP project and an important player licensed to extract the oil and build the pipeline.

Through a variety of different engagement forms with CNOOC – whether by providing loans, serving as underwriters, or taking stakes as shareholders – these western financial institutions continue contributing to EACOP’s damaging activities, despite their well-publicised claims otherwise.

EACOP

Starting from the Hoima district in western Uganda, the planned 1,443km long crude oil pipeline runs south toward Tanzania, then cuts east toward the Indian Ocean. In northeast Tanzania’s Port Tanga, the crude oil will be loaded onto tankers and shipped out around the world.

The consortium behind EACOP – which includes the U.K.-registered TotalEnergies, China’s CNOOC and the national oil companies of Uganda and Tanzania – has a touted capacity level of 216,000 barrels per day. In addition to lucrative revenue streams for its owners, the project is also intended to create jobs and infrastructure for the communities in Uganda and Tanzania. TotalEnergies is the biggest shareholder (62%) followed by the national oil companies (15% each) and CNOOC (8%).

Planning for EACOP began in 2013 with an assessed price of USD 3.5 billion. Yet as frequently happens with massive infrastructure developments, the costs of construction and management have steadily increased, with recent estimates indicating a total bill of USD 5 billion. EACOP’s shareholders are expected to finance USD 2 billion with the remaining USD 3 billion to come from external funding.

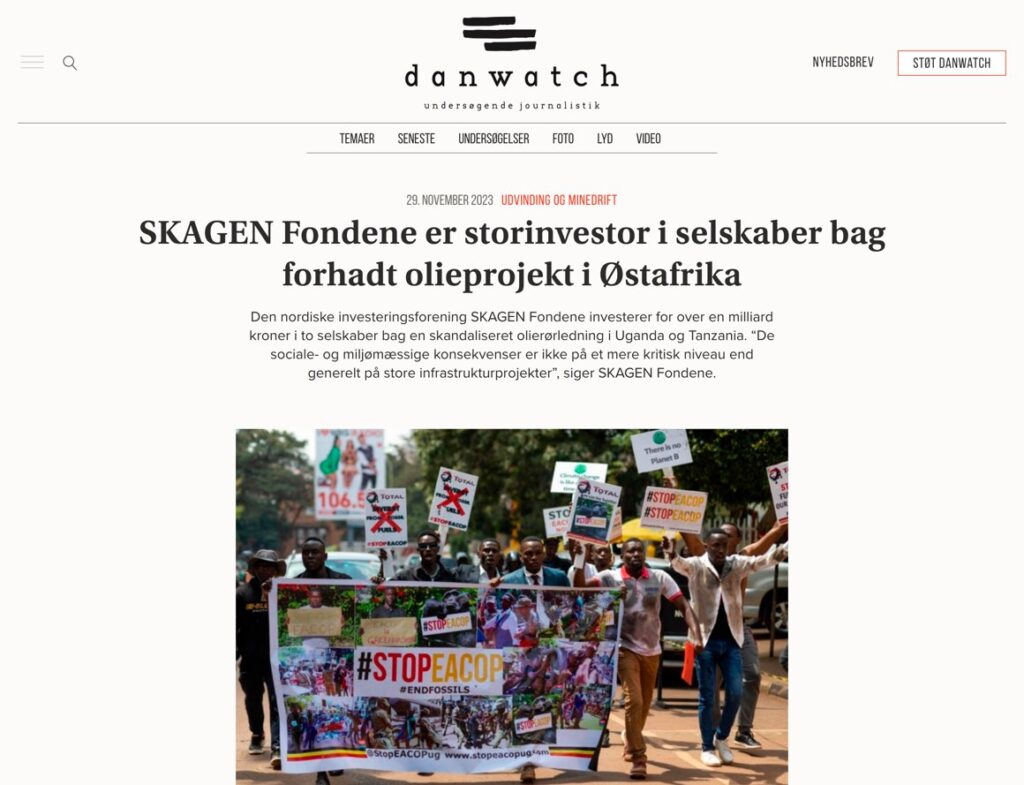

Protests have opposed EACOP since its inception. The most vocal actor has been StopEACOP, a global movement of civil society organisations with active advocacy efforts across both East Africa and Europe. StopEACOP criticises the pipeline project for irresponsibly extracting the region’s natural resources, displacing and devastating local communities, endangering wildlife and contributing to climate change. Led by local and international NGOs, protests against the pipeline have spread across East Africa and multiple western countries.

According to some expert assessments the project will result in 379m tonnes of climate-heating pollution. That is more than 25 times the combined annual emissions of Uganda and Tanzania, the host nations.

EACOP is also expected to be a major hazard for the biodiversity in the region. The pipeline will cross seven forest reserves, two game reserves, two game controlled areas and one open area that supports wildlife management. In total, the pipeline will cover 295 km of conserved and protected lands and impact nearly 2,000 square kilometres of protected wildlife habitats.

Just Finance International has frequently reported about violations of human rights and how it threatens the livelihoods of hundreds of families due to inadequate compensation for loss of land, crops and houses. This increases the vulnerability of elderly and disabled people, and female-headed households.

Even so, the EACOP consortium continues to refute the allegations from media and civil society, insisting that it is complying with the highest international standards, including the Universal Declaration of Human Rights and the UN Guiding Principles on Business and Human Rights. Total Energies has promised that “EACOP will be executed in an exemplary and transparent manner, taking full account of the environmental and biodiversity issues as well as the rights of local communities”.

And yet, many of the civil society groups who are monitoring EACOP’s development activity in Uganda, and even local community members who have participated in peaceful protests, are facing harassment. Among other forms of retaliation, Uganda’s human rights defenders have been subjected to government surveillance, cancellation of their operation permits, frozen bank accounts, repeated arrests, confiscated digital devices and even direct physical assaults by local police forces.

CNOOC, the unknown player

To date, much of the attention around the EACOP project has focused on the role of TotalEnergies. As the project’s main contractor, the company’s operations in the Tilenga oil field, located in the northern part of Uganda’s Lake Albert, have been a concentrated target for protesters.

In 2019 a group of civil society organisations filed a lawsuit against TotalEnergies in a French court. Under the suit, the activist groups accused the company of failing to adequately protect local populations and the environment from harmful development in the Tilenga oil field and EACOP. In March 2023, the French court dismissed the lawsuit, claiming that only a judge committed to an in-depth examination of the case could assess whether the accusations against TotalEnergies were founded.

Other public authorities have been more decisive. A September 2022 resolution by the European Parliament repeatedly singled out TotalEnergies for its “human rights violations,” “acts of intimidation,” “judicial harassment,” and “immense” risks and impacts on local communities, the environment and the climate.

All of this attention on the French multinational has allowed EACOP’s minority shareholder, CNOOC, to avoid much of the negative publicity. And yet, CNOOC, together with the Chinese state, holds substantial influence over the course of EACOP’s activities. In addition to its eight-percent in the consortium, the state-owned company controls 28.33 percent of the shares in the Tilenga oil project operated by TotalEnergies. As recently as this spring, the Chinese state-run (CQ) Export-Import Bank of China announced new loans for the pipeline, increasing China’s authority over the management of the project.

It is difficult to precisely gauge the level of Chinese influence and impact in EACOP and its host countries. The exact amount of Chinese lending has never been made public and the ethical practices of CNOOC’s Uganda operations remain opaque. However, according to some media reports, Chinese lenders will provide more than half of the US$3 billion debt that Uganda requires to build the crude oil pipeline.

CNOOC, on their hand, claims it aligns with universal principles of human rights, labour, environment, anti-corruption by having signed the UN Global Compact and its ten principles. But these high ambitions have not been visible on the ground in Uganda. CNOOC managers rarely, if ever, engage with representatives from the local communities, and are very resistant to questions from media and NGOs, according to interviews done by JFI.

The so-called Kingfisher area, where CNOOC overseas oil-drilling activities, prohibits visitors, including from NGOs and media outlets. Despite this, JFI managed to gather first-hand information from the Kingfisher oil field earlier this year. According to testimonies from project-affected community members, CNOOC’s oil operations have presided over multiple human rights violations, including forced displacement, confiscated fishing boats and disrupted livelihoods.

Project-affected populations, both in the Kingfisher region and areas along the pipeline operated by CNOOC, say that they were forced to accept unilaterally determined compensation and faced constant threats of involuntary resettlement and land acquisition. When EACOP’s construction enters its next phase, with the actual installation of the pipeline itself, many community members don’t know where they can go or how they can continue to support their families. They say the compensation they received for their houses, crops and land is grossly insufficient for buying equivalent land elsewhere.

Western investors continue to fuel CNOOC

In January 2021, the US administration blacklisted CNOOC, citing involvement by the company in the Chinese government’s intimidation efforts in the South China Sea. As intended, the move forced many American financial firms to sell their assets in the company. Meanwhile, other Western investors, finding ways around the blacklist measures, are sweeping up the shares at a discount.

To this day, a considerable list of Western banks and financial institutions continue to provide support for the parastatal Chinese oil company. An analysis by JFI of available investment data shows that the total funding from Western financial institutions is significant. Between 2016 and 2022 Western investors provided CNOOC with loans worth 4.7 billion USD. The market value of the 10 biggest shareholders was 342 million USD in December 2022. The list features several leading Western investment firms, which were still helping finance CNOOC at the end of 2022. These include Citigroup, Credit Suisse and Société Générale, banks that have all publicly announced their withdrawal from involvement in EACOP and published by the “Stop EACOP” campaign. And yet, at the time of writing this report, they still appear in the investor data as either shareholders or lenders.

One of the largest shareholders in CNOOC is Norway’s “Skagen Funds.” At the end of 2022 Skagen owned shares in CNOOC worth 136 million USD. Only 12 Chinese banks are bigger shareholders in the oil company.

JFI has reached out to all the finance companies in the list below for comment, and a summary of their response can be found here. Most of the investors argue that they can not disclose any information about their clients and are therefore unable to comment. Still, many of the banks and investors that responded claim that they will not invest in the EACOP.

What should the Western investors do?

Shareholders and investors in CNOOC have a golden opportunity to put pressure on the company and on its operations in Uganda and Tanzania. CNOOC must become more transparent, communicate with local communities, media and civil society. The company must also follow the ethical guidelines of the UN and others that they signed on to. If CNOOC is not doing this, the investors should immediately stop supporting the company.

The government of Uganda also has a role in the violations of human rights and many times it is hard to tell who is giving the orders to harass human rights defenders and community members. However, CNOOC has a big responsibility to put pressure on the government of Uganda to act in an ethical way according to international standards and to avoid further militarization in the project.

A vast number of affected people claim that they did not get fair compensation for their land, crops and houses during the acquisition. The operations on the ground should halt until all community members along the pipeline stretch are fully compensated and have been relocated according to international principles.

Communities along the pipeline have been promised schools, health centres and roads by the EACOP consortium. In many places where CNOOC operates such promised facilities are still missing. Shareholders and investors should put pressure on CNOOC to fulfil all what has been promised to the local communities.

CNOOCs 20 biggest western lenders and underwriters 2016-2022

| Lender/underwriter | Country | Total lending or underwriting USD million (Dec, 2022) |

| Citigroup | USA | 777 |

| JPMorgan Chase | USA | 672 |

| Goldman Sachs | USA | 672 |

| HSBC | USA | 416 |

| Credit Suisse | Switzerland | 416 |

| ANZ | Australia | 289 |

| Mizuho Financial | Japan | 265 |

| Société Générale | France | 237 |

| UBS | Switzerland | 149 |

| Banco Bilbao Vizcaya Argentaria | Spain | 119 |

| Groupe BPCE | France | 107 |

| Standard Chartered | UK | 103 |

| Princeton Capital Management | USA | 100 |

| Westpac | Australia | 100 |

| Mitsubishi UFJ Financial | Japan | 70 |

| ING Group | Netherlands | 59 |

| Clifford Chance | UK | 59 |

| SMBC Group | Japan | 56 |

| ABN Amro | Netherlands | 56 |

| Credit Agricole | France | 50 |

| Total | 4.772 |

List: The 10 biggest western shareholders in CNOOC

| Name of investor | Country | Market value of shares in USD million (Dec, 2022) |

| Skagen AS | Norway | 136 |

| HSBC Jintrust | China | 59 |

| Prudential | USA | 46 |

| Franklin Resources | USA | 35 |

| Lemanik Asset Management | Switzerland | 25 |

| Artemis Investment Management | UK | 18 |

| Aviva PLC | UK | 16 |

| Credit Agricole | France | 3 |

| Blackrock | USA | 2 |

| Samsung Life Insurance | South Korea | 2 |

| Total | 342 |

Facts about the financial data

This data was provided by Reclaim Finance (RF) and was originally provided for the Glasgow Financial Alliance for Net Zero (GFANZ) in January 2023. The research has been commissioned by RF and undertaken by Profundo. Both “pure” green loans and out of scope subsidiaries have been removed from the research prior to it being shared. Figures listed represent the total financing provided to the fossil fuel company and have not been adjusted based upon company activities.