Financing from development finance institutions (DFIs) and multilateral development banks (MDBs) often leads to big-ticket and large-scale infrastructure projects, which are, by definition, high risk.

Development finance-mandated projects, when not well-planned or in consultation with communities, can cause loss of livelihoods and involuntary resettlement, as well as the loss of people’s voices and their right to participation in decision making. And in many cases, violations of human rights and debilitating poverty.

Just Finance International works to make sure that shareholding governments and development institutions – DFIs and MDBs – improve governance and adopt binding and stronger environmental and social safeguard policies, instead of defaulting to the use of weak standards that may prove more attractive to their clients or client host governments.

News about Accountable Development Finance

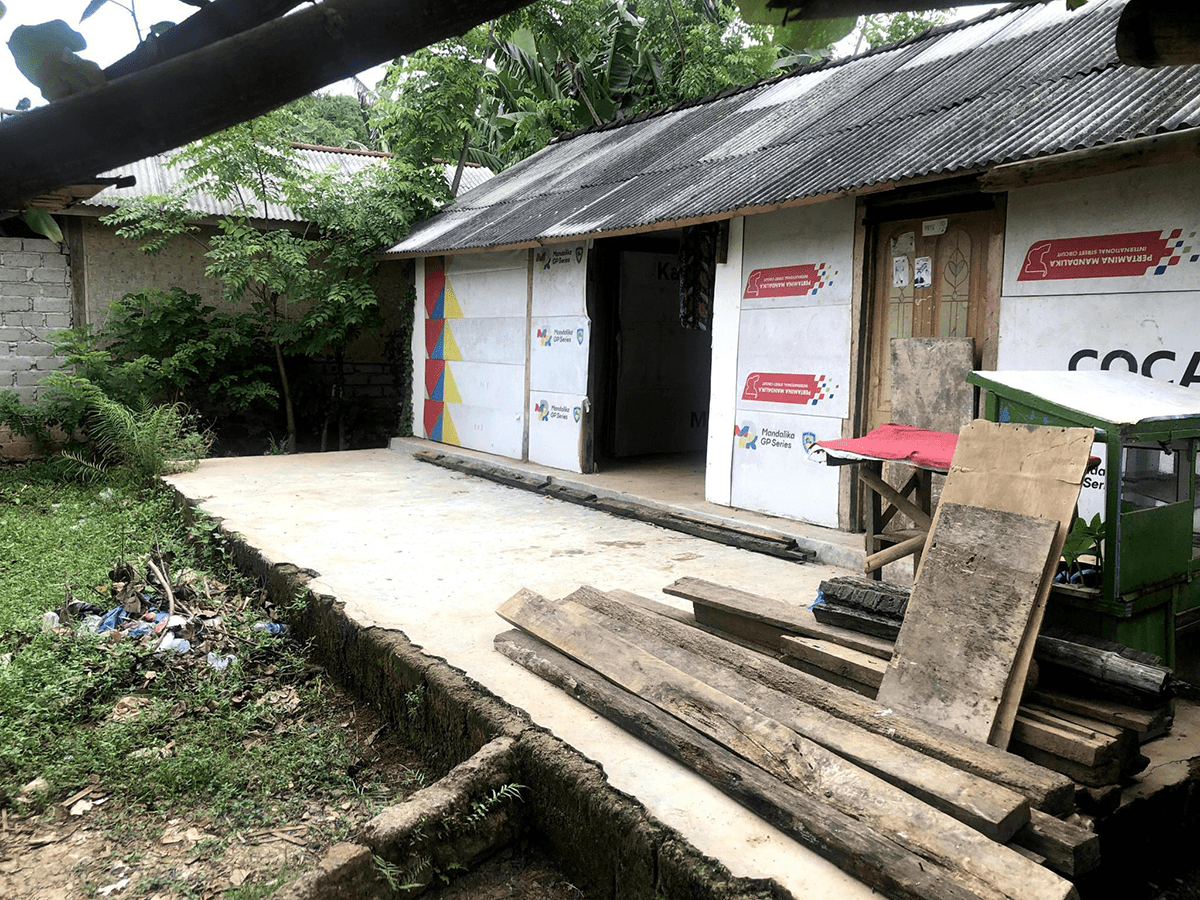

“I Am Ready to Be Killed!”: Snipers, Informants, and Persecution Ahead of Mandalika MotoGP Event

Leading up to the Mandalika International Street Circuit race, Indonesian state security forces imposed extreme intimidation and restrictions on local…

AIIB fails to meet Indigenous communities facing threats and evictions during site visit

For the full statement in Bahasa, please click here. Mandalika, 20 June 2023:- The Indonesia-based Coalition for Monitoring Infrastructure Development…

Survey of communities affected by the AIIB-funded Mandalika tourism project finds widespread human rights violations and devastating rise in poverty

Untuk membaca pernyataan pers ini dalam bahasa Indonesia, klik di sini.Pressemitteilung in deutscher Sprache, klicken Sie hier.Pour lire ce communiqué…